Florida’s Affordability: Price vs. Income

Florida’s median home prices rose 40%, but incomes only 12%. Understanding trends helps you and your customers enter deals with insight and creativity.

ORLANDO, Fla. – The median sale price for homes throughout Florida has been rising for a long time and accelerated between 2020-2022. The median sale price for a single-family home increased by 40%, while incomes increased by 12%. Even when interest rates took a bite out purchasing power, low levels of inventory kept pricing higher than historical levels in the state.

Examining the relationship between median sale prices and median household incomes gives a sense of how income and income growth relate to increases in price. A wide disconnect between incomes and pricing shows a lot about who’s able to buy – and who’s not.

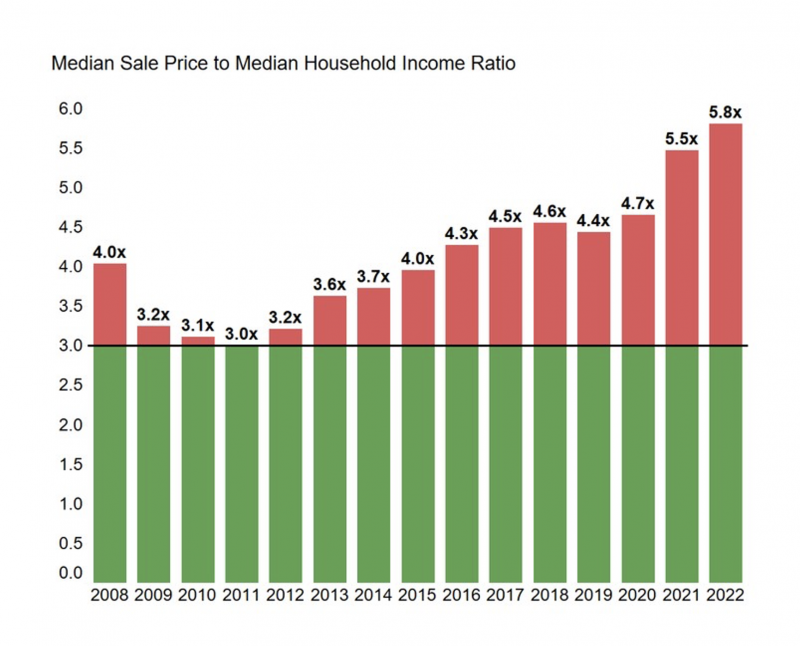

The following chart shows the ratio between income and housing sale price. Simply speaking, it illustrates how much more a median priced single-family home costs relative to the median household income.

An old personal finance rule of thumb about affordability is to purchase a house roughly three times your annual income. In 2012, for example, the median sale price for a single-family home was $145,000, which was just north of three times the median household income of $45,000. This ratio indicates that housing prices and incomes were pretty much aligned overall at the time.

Typically, even as housing prices rise, the ratio will change slightly as income increases. In recent years, however, sale prices rose at a faster rate than incomes, resulting in an imbalanced ratio. In 2022, a median-priced home costs six times the median household income. This imbalance represents a disconnect between earned income and price.

The reasons for this disconnect are myriad and include:

- Cash-out equity from other markets – People moving from pricier markets often have extra cash to spend in Florida’s lower-priced housing market.

- Cash-out equity from within Florida – Even within the state, people who are selling bigger homes with ample equity can leverage the cash for smaller or similar-sized homes.

- Fewer available homes keeping prices high – Owners with low interest rates are reluctant to sell, which limits listing and keeps prices high.

- Limited wage growth – While companies have been paying more, the Fed aims to control inflation, so rapid wage growth isn't anticipated. Rapid wage growth could fuel inflation.

- Beyond earned income – Retirees often rely more on passive income from retirement accounts, social security or investment dividends for living expenses and younger people may have inherited or acquired wealth. As more wealth moves into Florida, the gap between what earned income and the local cost of living becomes more apparent in the data.

The real estate landscape is changing quickly, particularly over the last few years. Continuing to seek out trends facing buyers and sellers puts you ahead of your competition. Take a moment to consider the changing financial equation throughout the state and your local area. Are you facing a market that resembles this disconnect or are things more in balance? Knowing what clients’ face allows you to enter each deal with understanding and creativity.

Jennifer Warner is an economist and Director of Economic Development

© 2024 Florida Realtors®